Every businessperson understands the need to know their numbers.

Income, gross and net earnings, and even having a clear idea of what you’re spending on your fixed assets are key to running a successful business.

But how many businesses effectively look at what those numbers look like in the next 3, 6 and 12 months, and are they monitoring their actual spending against the budget set?

Cash flow forecasting is a critical tool in any business’s armoury – assessing the numbers, planning, detailing the spend and reviewing where you are at, regularly allows you to strategically adjust where there is a need.

Keeping a tight grasp on your business finances is crucial and if you do not have strong cash flow forecasts you may find difficulty deciding how to invest in your business and how to get the growth that you are looking for or sustain the business through critical times.

This doesn’t need to be a daily assessment unless living hand to mouth but assessing where you are, every month, can prove to be a very useful activity to do. To do a cash flow forecast the first thing you need to think about is how far ahead you’re going to plan. This is slightly dependent on how much data you already have, but you need to be putting together a plan for at least 12 months or your next financial year.

This doesn’t need to be a daily assessment unless living hand to mouth but assessing where you are, every month, can prove to be a very useful activity to do. To do a cash flow forecast the first thing you need to think about is how far ahead you’re going to plan. This is slightly dependent on how much data you already have, but you need to be putting together a plan for at least 12 months or your next financial year.

For most businesses, it’s very simple to look back over a few months to see the average spend, assess where they are at and adjust accordingly. Very often the first time a business completes this task they are surprised by how much they spend in some areas, that is why it is a useful thing to do.

When you know what you have been spending and where then you can plan and make strategic decisions on where you want to spend your money going forward. This might mean that you need to do a little bit of belt-tightening, but it should also raise questions if the spend is greater than anticipated.

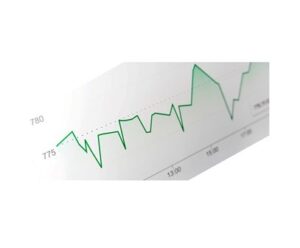

By putting down a monthly figure for the anticipated spending of each category you can do a monthly check and assess how close you are to your budget forecast. Over time, you will see where the figures are regular, or where there are peaks and troughs. It will give you a good focus and control on your finances allowing you to recognise where the changes need to be made.

If there is a significant overspend in one area you now know to rectify it by either cutting back in that category or transferring some budget from elsewhere. This leaves you in complete control of what that bottom right-hand corner will look like at the end of the year.

When you do this exercise, you may also find that you are making direct debits that you no longer need and that you are finding contracts that you have not monitored for value for money for some time. Spending a couple of hours assessing your expenditure each month could save you hundreds, possibly thousands of pounds.

If you are unsure of where to start this handy template will help.

Recent Comments